When a couple goes through a divorce it is usually one of the most stressful times of their lives. When a couple goes through a divorce and one or both of them own businesses, the intensity and stress are multiplied exponentially. Divorce can lead to losing a significant portion of the business’ future profits to a former spouse or, in the worst cases, the demise of the business. Neither of these options is enjoyable, especially for the spouse who spent years of their lives building the business. Understanding how a court will decide whether it should divide a business between divorcing spouses is the first step for a business owner to protect their rights.

Community vs. Separate Property

In Washington, the first thing a court will determine is whether a business should be divided. To make this determination, courts look at whether an asset is community property or separate property. If a business is deemed the separate property of one spouse, it is likely the business remain the separate property of that spouse. If, on the other hand, the business is considered community property, meaning it is jointly owned by both spouses, the court will divide the value of the business, or even the business itself, between the parties.

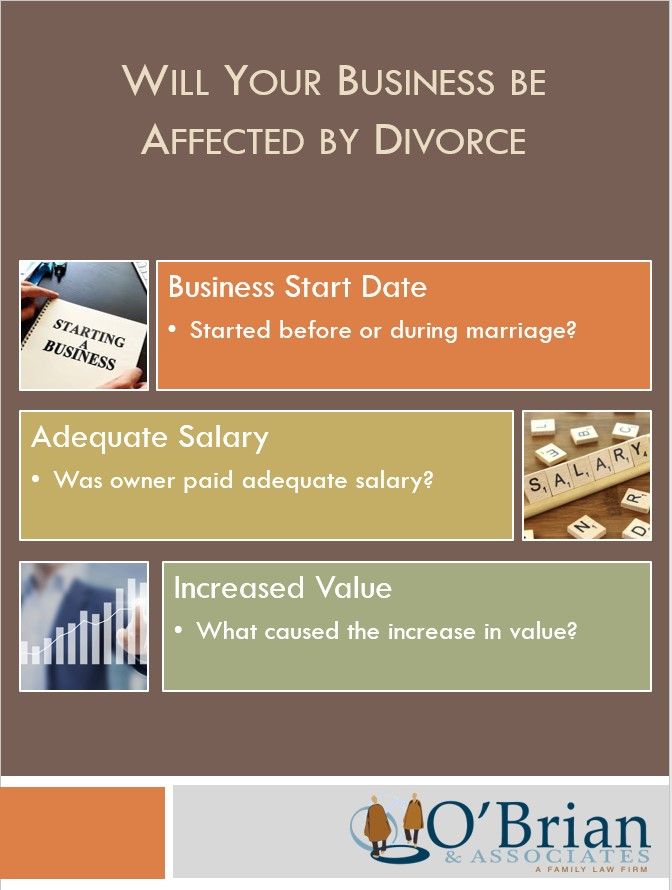

Below are 3 factors that will determine whether a business will be considered community property and subject to division by a court during divorce or whether it is the separate property of one of the spouses and not subject to division.

- When was the business started

The date the business was started can be a significant factor in determining whether a business is community or separate property. If one spouse started a business after the couple is married, there is a presumption the business is a community asset to be divided between the parties. This presumption can be overcome, but it means the spouse who started the business likely has an uphill battle.

If, on the other hand, a business is started before a couple is married, the business will likely be considered the separate property of the business-owning spouse at the time of the marriage. Unfortunately, just because a business is the separate property of one spouse at the time of marriage does not mean it will remain separate property, as the next two factors will show.

- Did the Owner Pay Themselves an Adequate Salary for Their Work

If a court determines a business is the separate property of one of the spouses at the time of marriage, it will also examine whether the business-owning spouse paid themselves an adequate salary during marriage. What is considered “adequate” is a very fact specific question that changes for each situation. In these situations courts are looking to make sure the business-owning spouse does not unfairly deprive the marital estate of funds earned from one spouse’s labor.

Many clients struggle with the idea that their labor is considered a community asset, meaning it is partially owned by their spouse, but that is one of the results of getting married. After a couple is married the labor of each spouse, and the earnings from that labor, is considered to be partially owned by the other spouse.

Because of this, if one spouse goes to work for their own business and pays themselves an inadequate salary, the court will probably want to offset this loss to the marital community by fairly compensating the other spouse. Courts can achieve this by awarding the other spouse an interest in the business, which would allow the spouse to collect a portion of the proceeds if the business is sold or a portion of future profits from the operations of the business.

- Was the Value of the Business Increased by Community Property

Another factor courts will consider in determining whether a business that is considered the separate property of one spouse is whether the value of the business increased during that marriage and, if so, what caused the increase in value. If the value of the business has increased because the business-owner spouse contributed significant amounts of community funds or if the value of the business has increased because of the personal labor or skills of the business-owning spouse, a court may compensate the marital community for contributing to the increase.

Contrastingly, if a business grows for some other reason—such as from the generation of profits independent from the owner’s involvement or because of its own valuable intellectual property—the court may decide the business should remain the separate property of one spouse. Similarly, if one spouse starts a business after the parties are married, but uses their own separate property to start the business, this could be a factor that overcomes the presumption that the business is community property because it was started after the marriage.

Fighting to protect a business is a complex process that requires a skilled and steady hand. If you are a business owner who is facing divorce, call O’Brian & Associates today. We have been helping business owners in Washington protect their businesses for over 30 years. We have the knowledge and experience you need in your corner as you navigate your divorce and fight to protect your business.

.1910111211550.jpg)